2025 Markets Are All About Tariffs and TACOs

Wall Street loves its acronyms, like any other group of people. In the 2000s, there was a big focus on BRIC investing (Brazil, Russia, India, China). By 2010, a few friends were casually asking about it. In the 2010s, we had TINA (There Is No Alternative to staying invested). Every financial wholesaler seemed to mention it. The latest acronym currently making the news is the TACO trade. Whether we knew it or not, the TACO trade was having an impact on our investments.

Chart of the Week

Last week, President Trump was asked his opinion of Wall Street’s latest craze. The president needed an explanation before he could answer, as I am sure many of us do. TACO stands for Trump Always Chickens Out. The term originated from The Financial Times about a month ago, but the idea of buying dips has existed for millennia.

You can imagine the President was unhappy to learn about it. I think the President likes being able to move markets. He just doesn’t like the acronym. Who would? Trump responded with an explanation of his tactic: scare others into action. I am personally more interested in the implications for investors.

TACO trading does not sound like a reliable strategy to me. Who can predict tariff headlines in 2025 without insider information from the White House? In the last week, the following happened.

Wednesday: U.S. trade court blocks all Trump tariffs, saying the President does not have this power

Thursday: The Court of Appeals pauses the immediate end of tariffs

Friday: Tariff negotiations with Europe are not productive. United States accuses China of breaking current trade agreement by withholding rare earth metals

Saturday: China accuses the United States of breaking the trade agreement first by withholding semiconductors

Sunday: White House officials state that the President will not delay tariffs again

Monday: Trump delays hike of tariffs on Chinese goods until August

All of this happened within a week. And if you think following the news is difficult, imagine being in the business of imports and exports!

Where does this leave Americans? If I am not mistaken, we still have 35% tariffs on goods from China. There is a lot of confusion, so let’s look at the shipping data to get a better understanding.

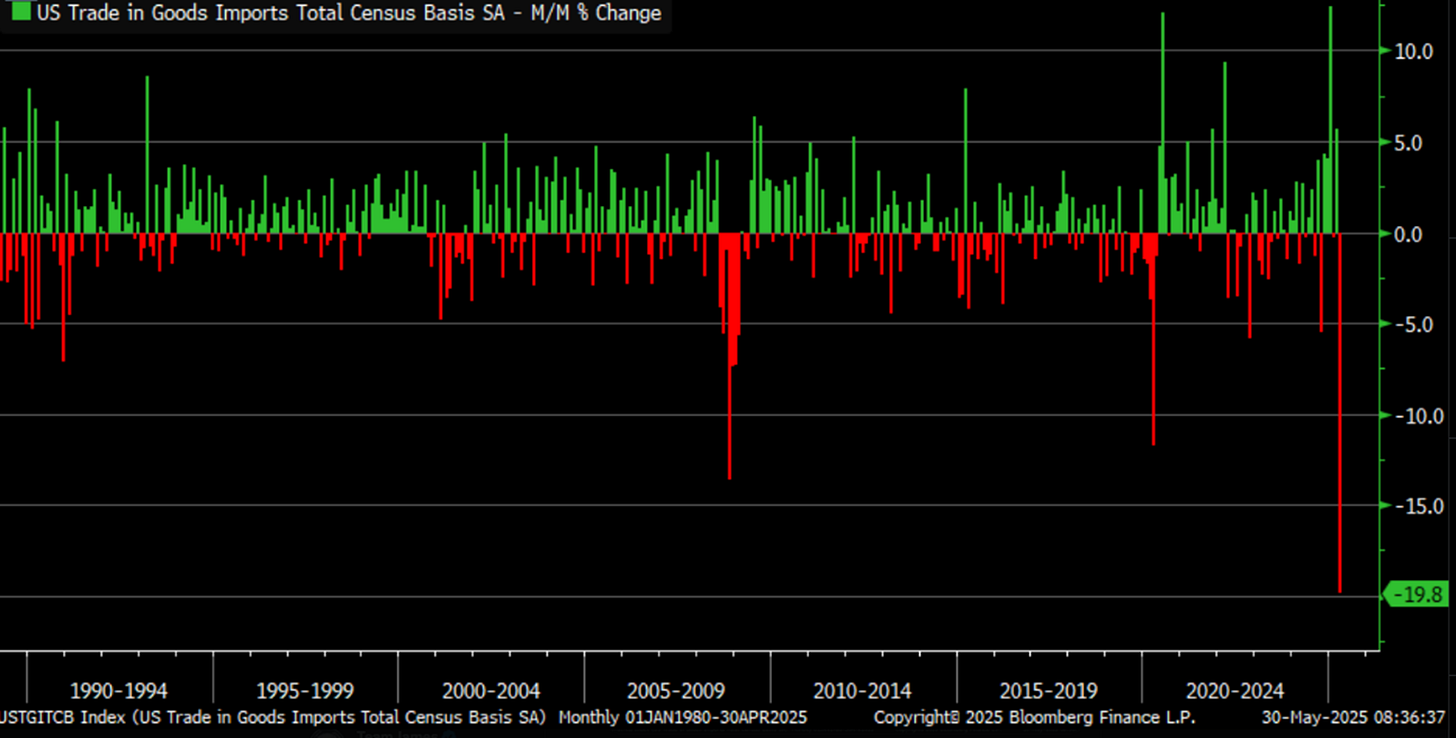

This chart shows the change in goods imported into the United States month to month. It encompasses the entire world, not just China, and offers many valuable lessons.

Trade is still happening. If it were not, then the drop would have been -100%.

Changes from month to month are far more volatile than one might think.

The largest red bars (reductions in imports) have occurred during difficult economic times (1991, 2008, 2020, and 2025?).

Our current drop in imports is the largest in at least 35 years.

There is a thick, green area just prior to our current drop. Retailers saw tariffs coming and increased inventory.

The inventory should also have been locked in at the pre-tariff pricing.

These retailers did not receive enough inventory to insulate Americans from the effects of tariffs forever, and changes will gradually be reflected in prices.

Expect economic volatility this year in the form of GDP. GDP lags and gets revised repeatedly. More importantly, for today, imports show up as negative GDP. A decrease in imports raises our GDP. This means the economy likely shrank a little during the rush to import pre-tariff. The GDP measurement will likely spike higher as fewer goods get imported April-June. It demonstrates how arbitrary some measurements can be. If we want to know what is really happening in 2025 then we will have to look beyond headline GDP figures or focus on other information.

If we want to know what it means to investors, then we better have a system. My signals are designed to look for opportunities to buy low and sell high. It's not easy and it is not guaranteed. While I do not like the extreme volatility of 2025, it has been beneficial for my strategies.

I reported making many portfolio changes in my last commentary. I am happy with how things have gone and have made few adjustments. Let's dive in and review where the markets stand, how current recommendations are performing, what I'm watching closely now, and where I traded.