A Window of Opportunity In November

Leading economic indicators continue to diverge from the current economy, and they are now so extreme that something is going to give. No one knows exactly when, so having a good investment strategy makes all the difference.

SFS ProActive Portfolios received their first buy signals in months, just as the stock market closed on November 20th. Opportunity knocked only briefly, and we acted quickly. Then that door closed. It never really opened that wide. We are now holding for the next opportunity. In the meantime, I cannot emphasize enough that Americans need to get their financial houses in order because next year will be very different from 2025.

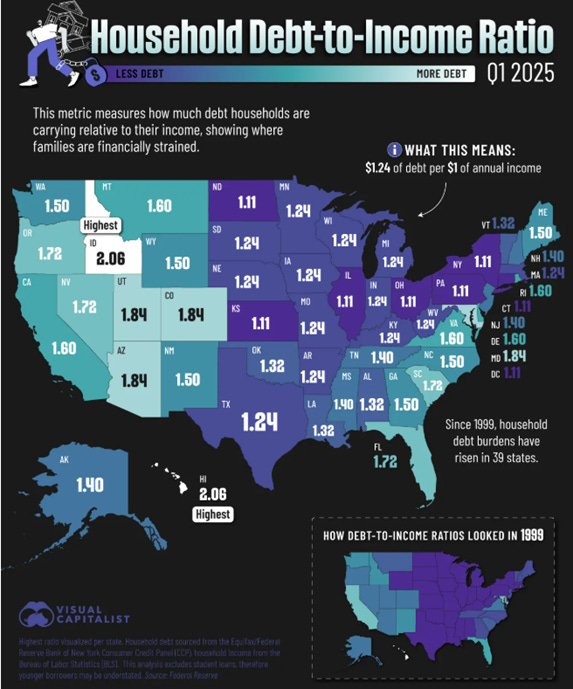

Chart of the Week

Those who understand interest receive it; those who do not, pay it. This adage does not bode well for my home state of Utah. As the Federal Reserve has lowered interest rates and printed money since 2020 (purchased assets), it has inflated prices across the board. Those who have assets have felt okay about the direction things have been going. Those who invest less have only experienced rising prices as an expense.

Economic Update

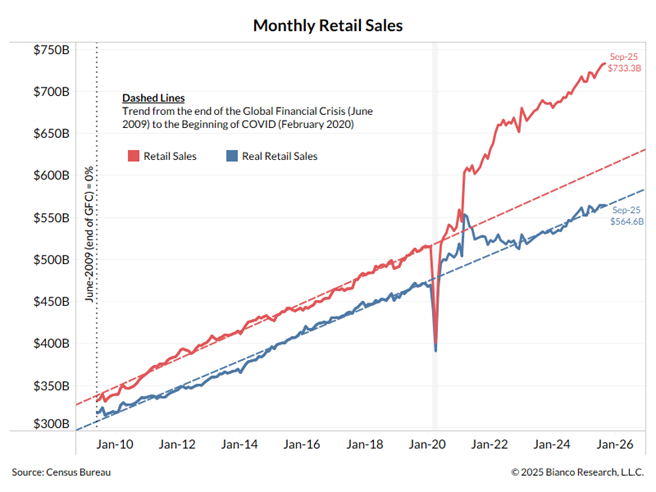

Consumer spending has been up over the last six years, big time! That red line in the adjacent graph exploded higher. Adjust spending for inflation, and it looks about the same as it has for the last 15 years. Inflation is powerful and stealthy.