All-Time Highs 📈

The S&P 500 reached an all-time high this week. Berkshire Hathaway subsequently sold out of all of the S&P 500. What does that mean to you and me? What are my signals saying to do? Inflation continues its tug of war, and what about the U.S. Dollar? Hang on; there is much to unpack in today’s SFS MarketPoint.

Chart of the Week

Berkshire Hathaway has sold out of all of the S&P 500. This is the company run by Warren Buffett, one of the greatest investors of all time. Buffett does not even believe in market timing. So he says. And Buffett is still investing. He has made significant changes. What does it mean for the rest of us?

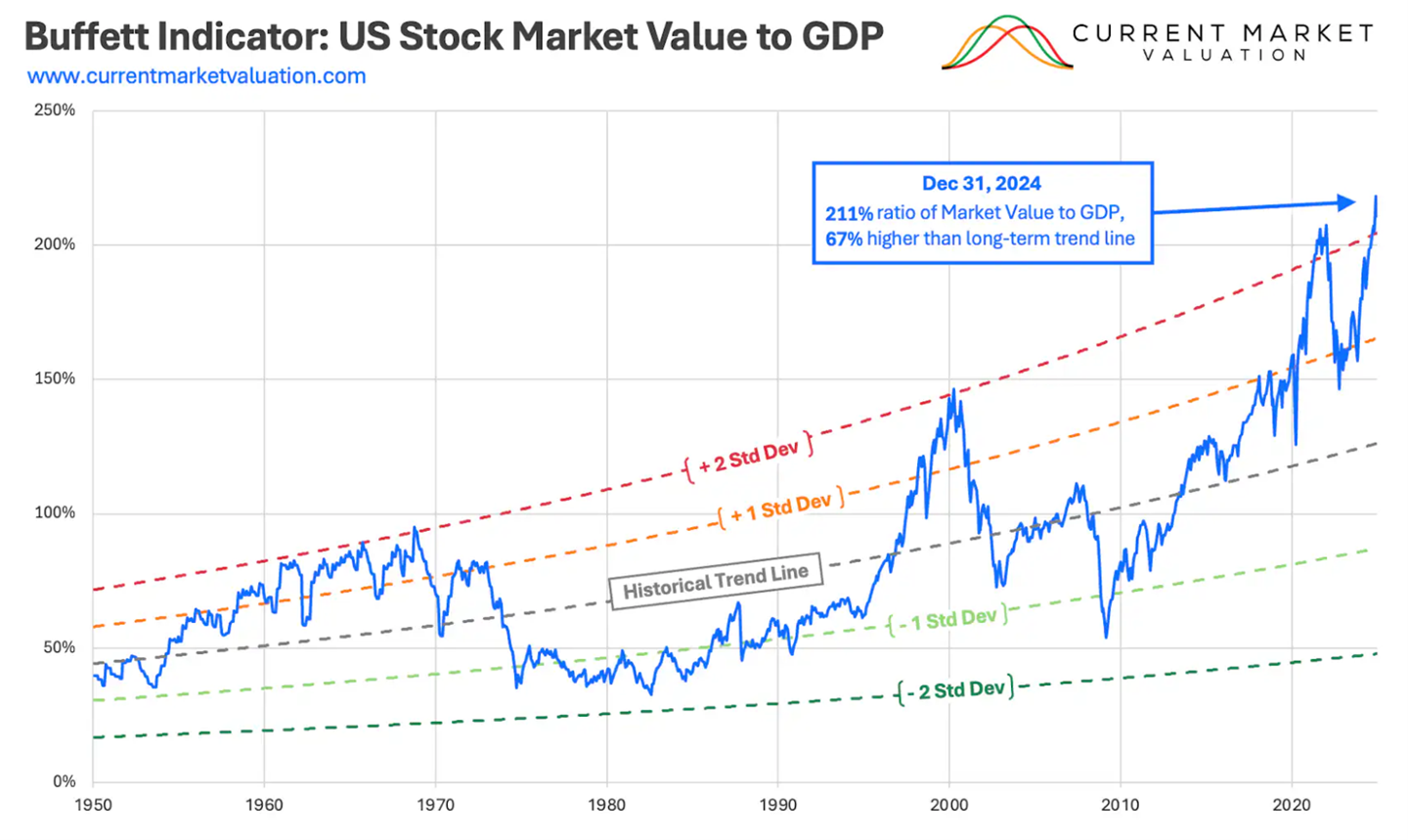

Consider the total value of the U.S. stock market divided by the size of the U.S. economy. The result is the Buffett Indicator. Stocks are attractive when they are low and expensive when they are high. Right now, we are deep in the expensive territory. In fact, it is so high that one should be asking, “Has something changed?”

Most Americans invest in the stock market. Politicians and central bankers have become major supporters. Buffett knows that stocks are not a high-yield savings account. They may rise and fall in value based on government-provided liquidity, but they represent ownership in companies. At some point, the fundamentals of these companies matter.

It is also clear that the Buffett Indicator is not a good tool for stock trading. It has rarely reached the light green line. An investor would miss out by waiting.

Market Update

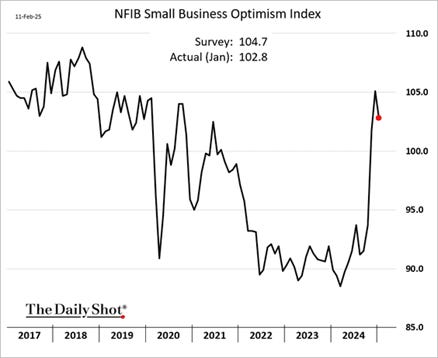

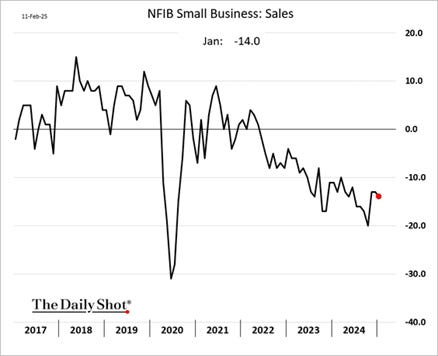

The S&P 500 reached all-time highs this week. Investors are incredibly optimistic about the economy. The small business optimism index illustrates just how positive people in these businesses feel. Despite the optimism, the next chart shows us that sales are still falling. This divergence should not last. If sales do not improve, optimism should decline.

What are my signals saying? One divergent signal on the S&P 500 just fired on Friday afternoon, and it is a sell signal. It was my first sell signal of the S&P 500 since July 5, 2024. I responded with a modest and measured reduction in risk across some tactical portfolios.