Americans Tap Brakes On Spending

Americans spend. It is a significant part of what they do. And when they run out of money, they borrow to keep spending. They take out mortgages, home equity loans, and auto loans and increase their credit card debt. They spend until the banks refuse to lend. Only then do consumers cut back. They are living this very thing in 2025.

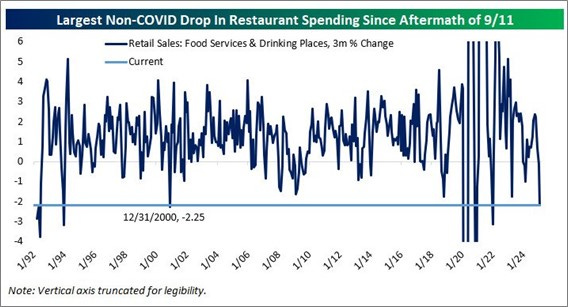

Chart of the Week

American consumers are cutting back. Restaurant spending is falling—something we have rarely seen. What would be rarer is if it persists in the coming months. Only time will tell. The impact will be massive.

Economic uncertainty is weighing on stocks. When uncertainty turns into big gains, we call it climbing a wall of worry. For this to happen, the hard data would likely need to stay positive. Will it stay positive?

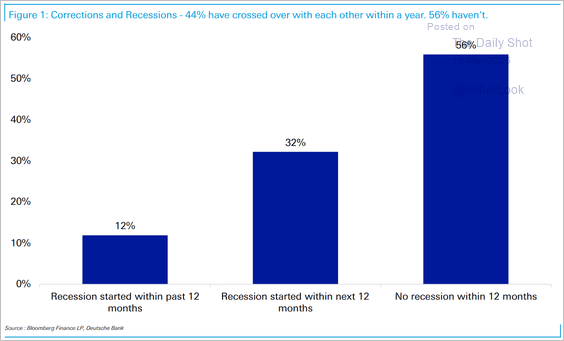

It has only been a couple of weeks since Goldman Sachs increased its probability of recession to 20%. I pointed out then that it was way too low. That firm has already changed the number to 35%, which is much more realistic. The most critical data does not confirm the slowdown, showing little sign of recession for now. Two announcements this week could have a significant impact.

Trump is calling April 2nd Liberation Day. He plans a big announcement at 3:00 PM Eastern. The stock market is not anticipating good news, nor does it appreciate actions taken on tariffs that have come in the last two months. Market reaction to the coming announcement will be important, but it is likely only going to add to uncertainty. The hard data comes on Friday (before markets open) when we get the jobs report.

The employment report is typically released on the first Friday of every month. It is widely seen as one of the most important data points for the economy. Inflation releases have stolen the focus in recent years, but if a recession were to come, that focus would shift radically toward the jobs report.

Investors want to know if consumer spending, tariffs, and government cutbacks are slowing down the economy. Most experts believe they are. The Department of Government Efficiency (DOGE) has announced massive layoffs in the tens of thousands. None of it feels significant to the economy unless you or someone you know is directly impacted. The impact on the rest of America comes if it begins hitting the entire economy. It is considered a lagging indicator, so I am not going to predict what will be announced on Friday. Let’s wait and see.

Market Update

The first quarter of 2025 was filled with extremes. The S&P 500 went from all-time highs in February to one of the fastest 10% drops ever. Bond investors, tired of inflation worries and tariff chaos, began buying in January, sending prices significantly higher in February and March. Underappreciated international stocks did fine as the U.S. dollar fell.

I expect a reversal as we enter the second quarter. Stocks are oversold. The so-called Magnificent 7 are in a bear market. The drop has been incredible. There is plenty of risk as economic uncertainty is high, but I expect a bounce. And these bounces can be significant. Until that happens, I am grateful for the bonds and dividend-paying stocks that I own. They have been helping.