Complacency Leads To New Highs

“Invest for the long haul. Don’t get too greedy and don’t get too scared.”

- Shelby M.C. Davis

Record highs in the S&P 500 have come as investors shrug off tariff chaos and higher inflation. The current beliefs that I hear are that (1) the White House will change its mind on tariffs and (2) artificial intelligence will solve all our problems. My belief is that investors are feeling good about recent gains and want more. It tells us little about what is coming.

Chart of the Week

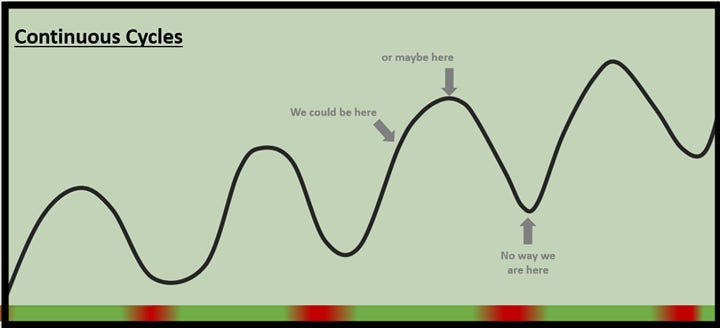

Please do not misunderstand. I am grateful to have the S&P 500 up for the year. I thought it looked attractive in March and early April. The economy has changed little since then. Stocks have changed a lot. Anything can happen, and we don't know what's coming. We do not know where we are in this chart or even if the next drop will be as big as is implied by this graphic. It probably will not.

What we do know is that stocks have risen in the long term. Whether we are near a short-term top or destined to keep going higher, sticking with our system is the smart strategy.

I have learned that buying is much better than selling after stocks drop. Nearly everyone has embraced the idea to the point that drops have become rare. I have seen this form of complacency before, and it is a good time to remember that looking at historical norms and probabilities is important. This is why we are managing our risk in the SFS ProActive Portfolios.