Escalation of Economic Warfare

President Trump is contending with seemingly everyone, from Federal Reserve Chair Jerome Powell to Chinese President Xi Jinping. Interest rates are going up. Tariff negotiations are hitting a wall. Optimists insist that more time is needed to see the results of the president’s economic policy. Investors are showing they are not that patient or believing. They do not like the direction of the U.S. economy.

Chart of the Week

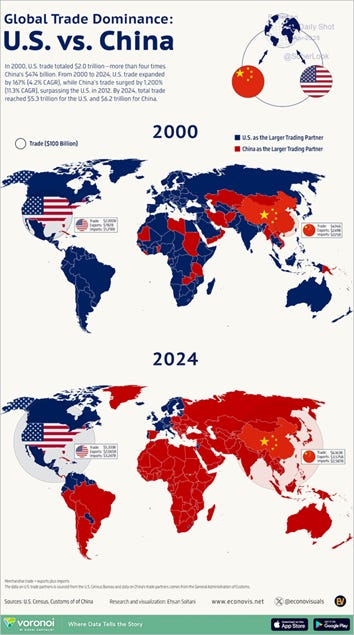

Investors seem to think the United States has made a mistake in tariff negotiations. China is not backing down. It announced yesterday that it would retaliate against any country that caved to U.S. pressure to target China.

American corporations will have a difficult time adjusting to tariffs. These companies willingly outsourced manufacturing to other countries over the last 40 years, especially China, to increase profits. They gave concessions to access China. Now, China dominates world trade. Reversing this is creating great uncertainty.

Interest rates are too high, yet they continue to move up. President Trump is targeting Federal Reserve Chair Jerome Powell with a threat to dismiss him. However, the rates moving up are long-term. The Fed controls the overnight rate, which is ultra-short-term. This year, the Fed has not moved on its rate yet because it is concerned about inflation shooting up. Data suggests this is a huge risk. Goods taxed by tariffs will cost more. These tariff announcements are coming quickly. Some change from day to day or week to week. Unless there is an emergency, the Fed plans to wait to see what happens.

The Federal Reserve is supposed to dampen volatility in the economy, making recessions less severe and reducing inflation over the long run. Its members are typically behind, but this is intentional. In my opinion, the Fed does a pretty good job of achieving both of its mandates. The only major blunder in the last 40 years was too much liquidity from 2020 to 2022, making inflation worse.

Removing the independence of the Fed from politics would damage the credibility of the United States on the international stage. The dollar would struggle as global investors begin to look elsewhere. Similar to what we are already seeing in 2025. Much more would follow if the Fed came under the control of political parties. This is something often seen in underdeveloped nations.

Market Update

Last week, I showed the U.S. dollar at a critical spot and discussed its impact on consumers and investors. It broke below the level I pointed to last week. This is not encouraging. It is the worst year-to-date performance of the dollar in any year in the last 30 years. That is the trend. The image this week zooms out to a very long-term history. We can see that we have been here before. We are still in a familiar area that has been visited many times over the last 35 years.

Stocks have been moving back down toward their lows for 2025—undoing nearly all the gains from the Trump-induced gains two weeks ago. Investors do not believe that the damage done to the economy can be undone with social media messages.

I am watching to see how low the market might go. As stocks move down, I am even more interested in buying low. If we reach new 2025 lows in the next week, I plan to be a buyer. According to my data, that low was around 4,835 in the S&P 500. Until then, or if it never comes, I am comfortable with my current positioning.