Growth, Debt, and Opportunities of 2025

Chart of the Week

Welcome to 2025. The U.S. economy is growing by around 2.5% (Atlanta Fed). Wages are up 4% (St Louis Fed). Unemployment is just 4.1% (Bureau of Labor Statistics). And the U.S. government is supporting all of this with recession-like deficits. Every dollar it spends will circulate through the economy, lifting wages, creating profit, and encouraging innovation. (It also keeps inflation sticky.) Excess spending eventually finds its way into the hands of those who do not spend it. Then, it is invested, helping to prop up values in stocks, bonds, and other assets. The most critical macroeconomic question of 2025 is, “What will the incoming administration do about government debt?” The level of spending is profound, so the answer will have a profound impact. I am staying invested and focusing on the areas that I see as most attractive.

Market Update

The S&P 500 stock index had its worst performance ever in the final week of 2024. It fell 2.5%, which was not so bad considering the gains that had come in the prior 51 weeks.

In my last commentary, I identified the energy sector as the most attractive as we enter 2025. I had already invested in it and hoped for an even more attractive opportunity to add more. I added more energy on December 23rd. I was not alone. Of the 11 sectors in the S&P 500, energy was the top performer in the last week of the year and the only one that made money that week. Positive momentum seems to have carried into the new year.

How about the other sectors I mentioned? Healthcare continues to look attractive, according to my measures. Many other areas of the market are getting attractive as well. I will discuss bonds in detail in the Emerging Opportunities section.

Economic Conditions

Consumers are turning to credit cards to fund their lifestyle. This is not the time to carry a balance. Those who cannot pay off the balance each month are getting crushed. According to the Federal Reserve, the average interest rate is currently 23%.

We have seen this movie and have a good idea of how it will end, but not when it will end. Everyone, including the government and the very banks that are lending, want to keep the growth coming. Most economic metrics are indifferent to debt. A dollar spent is a dollar of profit and a dollar of GDP growth.

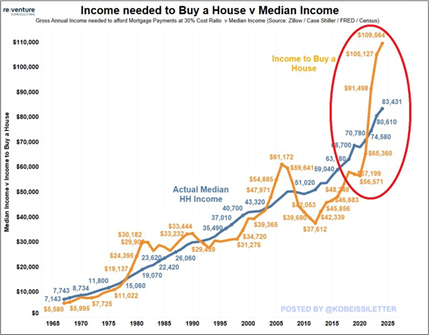

Home prices continue to defy the gravity of increasing mortgage rates because the number of homes for sale is still relatively low. Homeowners have little financial reason to sell. Around 40% have no mortgage. Approximately 85% of those with a mortgage have a rate under 6% (Redfin). Around 55% have a rate under 4% (Realtor.com). If they place their homes up for sale, their next mortgage rate would be closer to 7%. Unless forced to sell, the supply of homes for sale will likely stay tight.

Market Trends

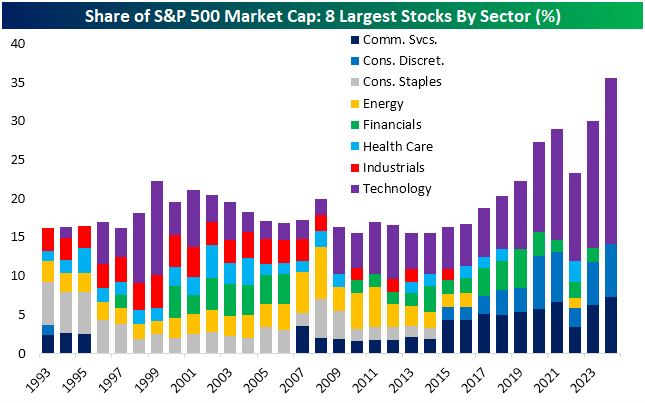

News flash: buying the hottest thing on Wall Street does not give you participation in its past return. You only get what’s coming. The momentum may or may not continue. Young investors may have a hard time understanding that something else can lead the way. (The S&P 500 is roughly 30% technology. So, most investors own a lot more than they know. It’s been good, and now there is a lot of potential for change.

In the chart of the largest stocks by sector (Bespoke Investment Group), you will notice that the energy sector (yellow) was relatively small in 1999. By 2008, it was the largest sector in the S&P 500. Since then, it has gradually declined. Technology was exactly the opposite. It started its comeback in 2009. Healthcare (light blue) only recently has fallen out of favor.

Emerging Opportunities

Bonds look attractive compared to recent history. Many investors overlook fixed income, creating opportunities for the rest of us. However, the opportunity may hinge on the federal government.

1. Fiscal Deficit: The new Department of Government Efficiency could have a significant impact. Efforts to reduce government spending would be good for bonds. Continued deficit puts negative pressure on bonds.

2. Fed Policy: Poor bond performance in 2024 reflected disappointment with the Federal Reserve declaring victory over inflation despite not hitting its 2% target since 2019. Inflation makes bonds less attractive.

3. Tariffs: A one-time bump in prices should not have a long-term impact on bond values, but there is a lot of uncertainty around international trade and tariffs.

4. Funding Choice: The U.S. government not only has to borrow for the $3 trillion in new debt but must also refinance portions of its existing $36 trillion in debt. More bonds must be purchased by someone, which can drain some liquidity from financial markets, creating a headwind for all assets.

We will have some answers by the end of January, but most will unfold over time. We deal with this uncertainty daily as investors. One cannot be successful without embracing it. In the summer of 2008, long-term U.S. government bonds were the right trade. By the time investors realized it, a rally of epic proportion had already taken place. I believe we are reliving 2008. However, I have positions in bonds and added to them near current levels. I'm prepared to add more if they become even more attractive. I will stick with my process of seeking the best opportunities and identifying potential turning points.

Making sound decisions and sticking with them over the long haul is the cornerstone of investment success. The mission of SFS MarketPoint® is to deliver weekly insights into the economic landscape and spotlight emerging opportunities for investors. Our proprietary system identifies sector and asset class rotations within the markets.