In a Changing World, Focus on What You Know

Stocks are rising as if the trade war is over, and interest rates are climbing like the conflict has just begun. Economic crosswinds abound, but I am sticking with what I know: markets tend to rise over time, investors often overreact, and the media is slow to identify opportunities. These offer no guarantees, but they are incredibly helpful in a changing world. I made many changes to our tactical portfolios in the last week. Before going there, let’s discuss what happened last week.

Chart of the Week

Moody’s downgraded its rating on U.S. debt on Friday. The last two times something like this happened, stocks plummeted. But by Monday afternoon, the Moody downgrade was old news. The major indices were little changed. I draw two powerful conclusions from the downgrade dip and recovery.

(1) The U.S. fiscal situation is a mess, and politicians are relying on hope to fix it. They are hoping that they can grow the economy faster than debt goes up. I love the sound of that, but this has been the wish of every politician. As Milton Friedman said, "One of the great mistakes is to judge policies and programs by their intentions rather than by their results."

(2) It appears that too many investors sold stocks near the bottom and now want to get back in. To those buying back into the markets the last few days, my indicators say, "You should have stayed in." This short-term move looks tired.

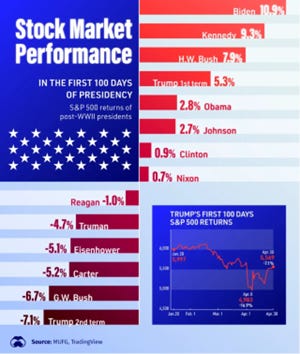

The S&P 500 stock index has completed a recovery for the record books. It began with the worst start to a presidential term in modern history. Then, after losing roughly 20 percent in under 2 months, the index gained 20% in under 2 months.

Most investors do not enjoy volatility to this magnitude, but markets do not care much about what investors want. As investors, we get ready, and we react.

Over the last week, we have been preparing for changes. When Moody's downgraded its rating on U.S. debt on Friday afternoon, we did not panic. When markets reacted better than expected on Monday, we welcomed the response.