Investors Are Doing the Fed’s Job of Fighting Inflation

Chart of the Week

The Federal Reserve (The Fed) was created to dampen the economic volatility caused by inflation and unemployment. After the Panic of 1907, Americans decided that waiting for the "free market" to correct excesses was too painful. The Fed was created in 1913 to dampen the risks before they got too big. Fast forward to 2025. The federal government has been spending heavily for eight years. It borrows, and the Fed enables it with a large balance sheet and encourages its continuation by dampening consequences. This does not bankrupt the country. It encourages inflation. As the Fed has not adequately contained that inflation, the market has started doing it.

The official CPI reports a 32% inflation rate over the past decade, but real-world prices tell a different story. Inflation at McDonald's is worse than expected. In 2014, a Quarter Pounder meal was $5.39. By 2024, it costs $11.99, a 122% increase. A medium fry is nearly $4. These prices don't even account for changes in portion sizes, quality, or nutrition. Housing prices have also surged, with the median home price rising from $281,000 in 2014 to $420,000 in 2024, a nearly 50% increase. Don't get me started on the cost of college tuition and insurance. Inflation hurts!

As investors, there is always opportunity. Some may even benefit from sticky inflation. Others may be even more attractive as rates rise.

Market Update

U.S. oil production is the highest in the world, and green energy solutions are gaining traction. Nuclear energy is also making a comeback. It has always been economical and relatively environmentally friendly. Public opinion has now shifted as well. The need for many sources of energy will continue. My system flagged the energy sector as attractive last month. I noted it in my December 17th commentary. I added significantly to investments in the energy sector 6 days after that. Since then, energy has continued to be the top performer of the 11 sectors of the S&P 500 index. In the first two weeks of the year, the energy sector is up 5%, while the S&P 500 is slightly negative. (Second place goes to the healthcare sector, which I also have been recommending.)

Markets will bounce around, and the areas that are the most beaten up usually get the best bounce. I will wait until my system identifies a sizeable opportunity. I am not planning any major changes unless bonds present an even better value this week.

Economic Conditions

The USA CPI chart compares our current bout with inflation to the one that began in the 1970s. While the Fed believes they have accomplished their goal and started cutting interest rates aggressively, they have not yet deviated meaningfully from the painful path of prices in the 1970s. With all their experience, knowledge, tools, and beneficial adjustments to CPI measures, the Fed has not reached its 2% target after 5 years.

The Fed needs to get serious about fighting inflation in 2025. Consumers now expect higher prices, which makes inflation pressures stickier. We will not follow the path of the 1970s, though. The debt levels in the U.S. government and among consumers are unfathomable compared to 45 years ago. The economy is going to be more sensitive to rates. It is already putting pressure on stocks.

Market Trends

While the U.S. dollar may not go far at McDonald's, it has appreciated internationally. However, this trend may not last. President-elect Trump previously tried to weaken the dollar in 2017, arguing that a strong dollar isn't always beneficial. If the dollar's value reverses in 2025, it could present new investment opportunities.

Emerging Opportunities

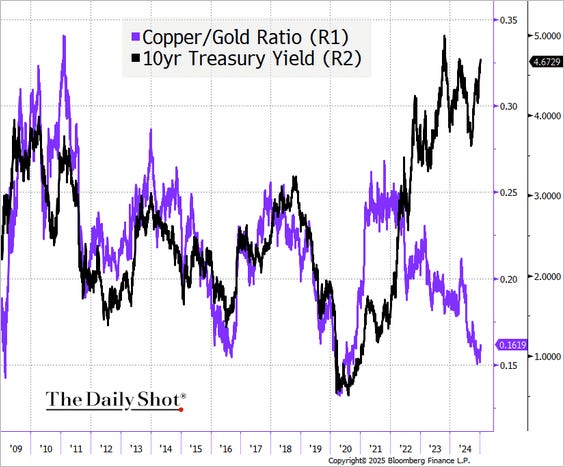

This graph illustrates the correlation between the 10-year interest rate and the copper/gold ratio. While these lines have mirrored each other, there is no inherent reason for this to continue. The ratio should reflect inflation (copper) and investor demand for safety (gold), both of which significantly impact bond attractiveness. A potential convergence could lead to falling bond yields and rising bond prices.

Last week, I highlighted the growing attractiveness of bonds and my intention to increase holdings. Despite their appeal, I have yet to make any trades, preferring to wait for even better value or more oversold conditions. I recall the summer of 2008 when inflation fears blinded investors to the impending shift, underscoring the importance of patience and strategic positioning.

Making sound decisions and sticking with them over the long haul is the cornerstone of investment success. The mission of SFS MarketPoint® is to deliver weekly insights into the economic landscape and spotlight emerging opportunities for investors. Our proprietary system identifies sector and asset class rotations within the markets.