Investors Say “No Thanks” to Trump’s “Liberation Day” Policies

President Trump created unprecedented hype around his latest economic policy, declaring last Wednesday "Liberation Day." Investor reaction came swiftly and decisively. The S&P 500 had one of its quickest, most powerful selloffs in history. What comes after such a selloff? Keep reading, and we will dive into that today.

Chart of the Week

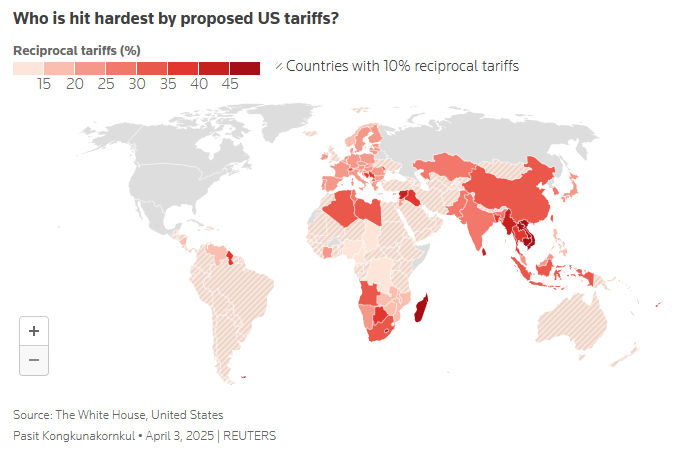

Tariffs will raise revenue for the United States. This is not open for debate, and it is why some are backing the idea of charging foreign countries to sell us their goods. If only it were as simple as the adjacent map, which is incomplete. It shows no impact on the United States. I see the tariffs as gambling with the world's most powerful economy. The true impact will depend on the secondary effects of tariffs:

1. Reduction of efficiency: Manufacturing moves to areas with a competitive advantage. This lowers the costs of goods and, in theory, benefits all parties involved. Tariffs change the equation. Less efficient manufacturing will push up costs.

2. Higher Prices: Who ultimately pays the tariff to the U.S. government? If prices go up 24% to pay for the 24% tariff, then it is the American consumer. According to Fidelity Investments, a 24% tariff will likely cause an 8% increase in prices, plus an 8% reduction in the value of the U.S. dollar, and the final 8% will be a loss in profit for the companies involved.

3. Slower Economy: A rise of 8% in prices is inflationary and will cause consumers to cut their spending.

4. Lower Tax Revenue: Slower economies mean less income.

5. Time: It will take some years for companies to adjust. Many are likely to pause new projects until the dust settles.

Investors are aware of all this. Higher prices and a slower economy are known as stagflation. The key to avoiding it is overcoming point one: Creating new efficient factories to produce goods in the United States. All the other issues are mute if we can achieve it. If we do not, the best thing would be to negotiate with our trading partners to remove these tariffs before all the secondary effects occur.

Market Update

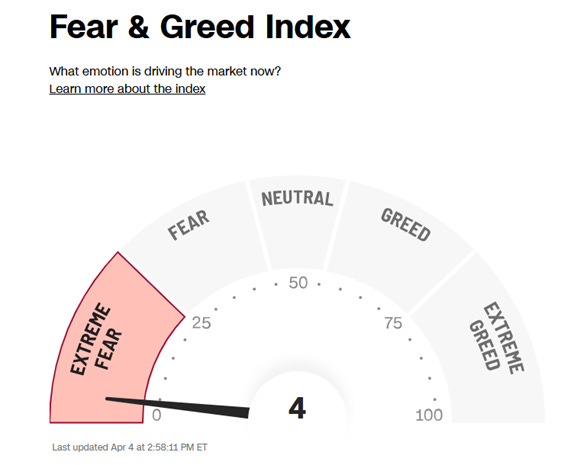

Investor sentiment is rarely this low. Typically, by the time we get this low, everyone who is thinking about selling has already sold, and we are very near a significant move higher. This does not mean that all our problems are in the rear-view mirror. It just means the worst may be behind us for now. Where we go in the next 3 to 18 months will depend on many things that have not happened.