Market Whiplash: Tariffs, Tech, and Extreme Sentiment

This week has been nothing short of stunning, marked by significant market volatility and a sense of delusion among some investors. Optimism reigned as companies like Tesla, despite lackluster Q4 results, moved up. Speaking of Tesla, Alexander Potter, an analyst at Piper Sandler, noted, “Q4 results weren’t great, but who cares? Elon has never sounded so bullish.” This sentiment was echoed after Meta reported that it was no longer buying back shares of its company and the CEO, Mark Zuckerberg, was selling. Apple reported declining iPhone sales, which have not grown in three years. Investors initially pushed the stock price up by 5%, only to see all those gains evaporate within 24 hours. Retail investors are seeing the glass half full, but reality hit back hard this week.

Chart of the Week

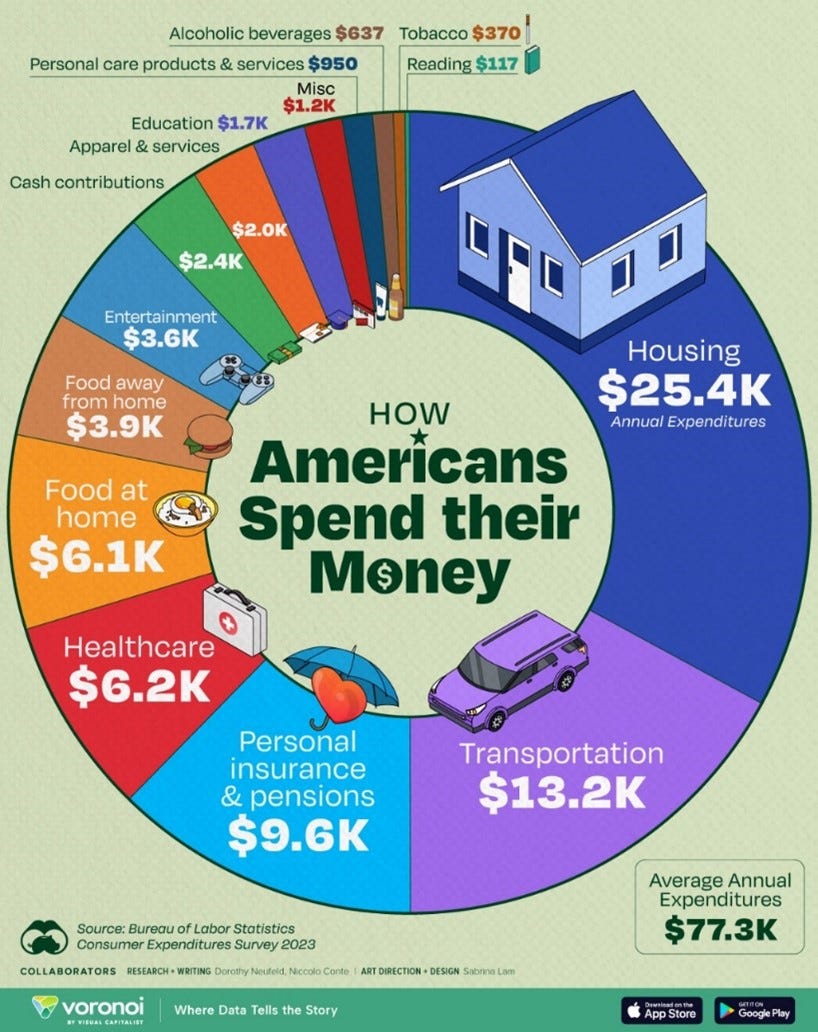

Americans are spending more than they save, with rising prices boosting company profits. Tariffs are back, and despite skepticism, President Trump confirmed a 25% increase, causing market volatility. Stocks dipped after a brief rebound, but it was a positive week for my recommended overweights.

Gold hit all-time highs, but no changes were made. Oil and energy stocks are down, but recommendations remain unchanged. Bonds bounced back, and I'm watching for opportunities in bonds, small-cap stocks, and internationals. I'll add significantly when the time is right.

Market Update

The key macroeconomic question for 2025 is, "What will the new administration do about government debt?" We'll get our first clue on February 5th. Government spending has been propping up the economy, so any changes will have a big impact.

Scott Bessent, the new Treasury Secretary, has criticized his predecessor for issuing a lot of short-term debt, suggesting it was politically motivated. This week, Bessent will outline his plans.

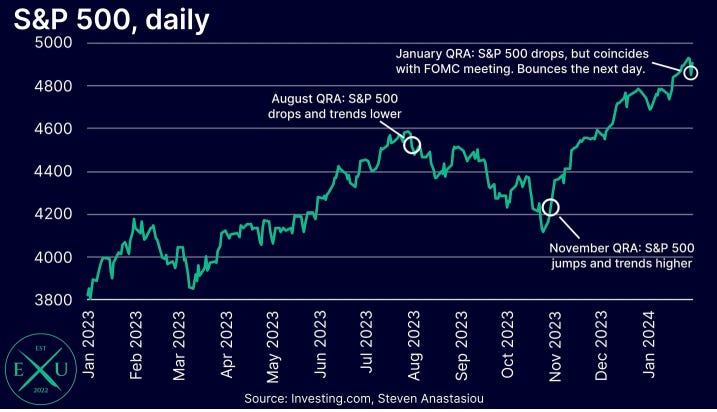

The U.S. Treasury will announce its Quarterly Refunding Announcement (QRA) on February 5th. The Treasury wants its checking account (TGA) at $850 billion. The big question is how much intermediate and long-term debt will be issued, which affects market liquidity. This triggered a 10% market selloff in August 2023 and a subsequent rally three months later.

I’m staying invested according to my benchmarks, with overweight in energy, healthcare, and gold. Bonds are showing positive momentum despite inflation issues, and the U.S. dollar seems to be topping out. This is a big opportunity, but I will wait for the QRA before buying more.

What the government says it will do next may be more important than what they have already announced. Stay tuned.