Markets Near a Tipping Point?

It felt like markets only went down. Now, it feels like they only go up. Neither is true. Tariffs continue to drive media headlines and the stock market. Investors continue to buy with optimism, which we have not seen in many months. My signals are suddenly as exciting as they were in March and April, when they were screaming “buy.” Beginning today, May 13th, they are flashing warning signs.

Chart of the Week

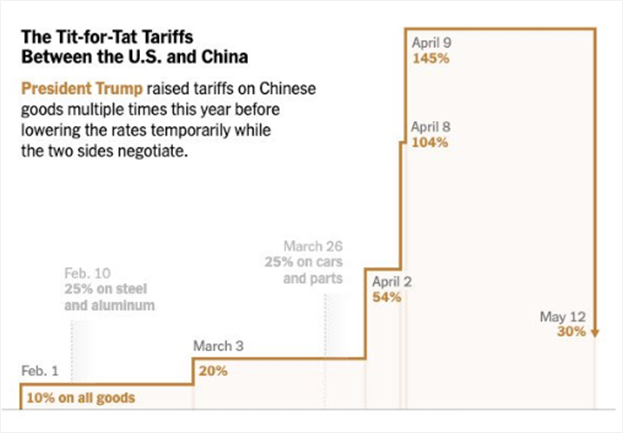

Tariff news is challenging to track. There are so many changes to various categories. The narrative is much easier to feel: Tariffs were going up, and now they are coming down.

Tariffs on Chinese goods bumped to 10% in February and 20% in March. Stocks were in an absolute panic. For one month, U.S. tariffs on China trade were greater than 100%, which essentially shut down all direct trade between the two. President Trump had stated that his primary goal was to bring back manufacturing and lower interest rates. He panicked as stocks collapsed.

Tariffs are a form of tax that no one wants to pay. The current level of 30% (imports) seems reasonable compared to where we were. This explains the bullish attitude of investors. I cannot help but wonder if, at some point, we all realize that a 30% tax on our spending is not good. (Graphic provided by the Kobeissi Letter.)