Politics Cannot Predict Markets

Plus: Artificial Intelligence Update

Americans are facing economic challenges that are far greater than anything in 2017. Investors initially cheered Donald Trump’s return to the Oval Office. However, they have done the same in the first week for every new president since Ronald Reagan took office in 1981. The honeymoon is over now. A disruption in Artificial Intelligence technology this last week sent investors into panic mode and will now propel us into the next stage of the AI revolution. Keeping the economy strong will be critical, and if things get weak in 2025, I have some investments I am watching just in case.

Chart of the Week

The world economy and markets are completely different than they were 8 years ago. Trump’s first term in the White House will not be a good proxy for the next four years. Interest rates are way up. Taxes are already down. Home prices are stubbornly high. Global trade is declining. Government interest payments are through the roof. And stocks are expensive.

I have done far better as an investor by running a system that does not get blown off course by political winds. The graphic explains why. Tech stocks soared over the past eight years, regardless of who was in charge. Energy companies were supposed to be good with a Republican president but did far better with a Democrat in office.

I am currently still excited about energy, healthcare, and precious metals. I have not added them recently. In fact, I sold some healthcare on January 27th—based on my signals. I have some warnings about the U.S. dollar, which means I am watching to add to more international stocks and U.S. bonds.

Market Update

Nvidia just experienced the most significant dollar loss of any single day for a U.S. company in history. It fell nearly 17% and dragged down the entire S&P 500, which finished the day with a loss of 1.5%. The largest losses in the S&P 500 came from the technology sector, representing a significant 33% of the index. On that same day, 300 of the 500 stocks in the S&P index were positive, which had never happened before.

The sudden drop was triggered by a breakthrough in artificial intelligence coming out of China. The U.S. government had tried to stop companies in China from obtaining the semiconductor equipment needed for state-of-the-art AI. Ironically, this forced a company named DeepSeek to develop more efficient technology. It now has AI capabilities that appear to be as good as any developer in the world, manufactured for around 97% less money, a fraction of the manpower, and with inferior semiconductor chips.

It will take some time to determine the implications of lower-cost artificial intelligence. I expect some continued volatility as companies try to determine what their profit margins will look like in this changing world. The impact should be positive in the coming years, lowering costs so that more companies can develop useful software for cutting costs or making more money. Here are some stages of AI from my perspective:

1. Discovery: AI technology works and people notice (2022-2023)

2. Picks and Shovels: AI buildout begins (2023-2024)

3. Constraints: Semiconductors and electricity needed (2024)

4. Democratization: Costs come down and improve AI access (2025)

5. Agent Creation: End users get tools to improve life, cut costs, and/or raise profits (2025+)

Investors are not throwing the baby out with the bathwater. Many sectors of the S&P 500 were positive even on such a negative day. The top performer: Healthcare!

Economic Conditions

Many Americans have fallen behind on debt payments. Borrowers considered high-risk fall into the "subprime" category and can only borrow if they agree to pay higher rates. The percentage of subprime auto loans that are 60 days or more behind on their payments is 6.2%. It resembles years like 1997 and 2019. The economy is still doing fine, but higher interest rates are proving too high for the consumption of this group. How will it ripple through the entire economy? Fortunately, subprime auto loans only represent around 17% of all auto loans. The low default levels for prime borrowers are far more significant.

Market Trends

Energy production in the United States has never been higher. Oil imports from Middle Eastern countries are on the decline. This adds to economic stability. Much of the natural gas is used in electricity production. Thanks to data centers, demand for electricity is making its first significant rise since WWII.

Many people will be surprised to learn that the best-performing sector in the S&P 500 in 2024 was not technology. It was utilities. It has slowed down recently, but it still looks acceptable to me. I am holding what I already own.

Emerging Opportunities

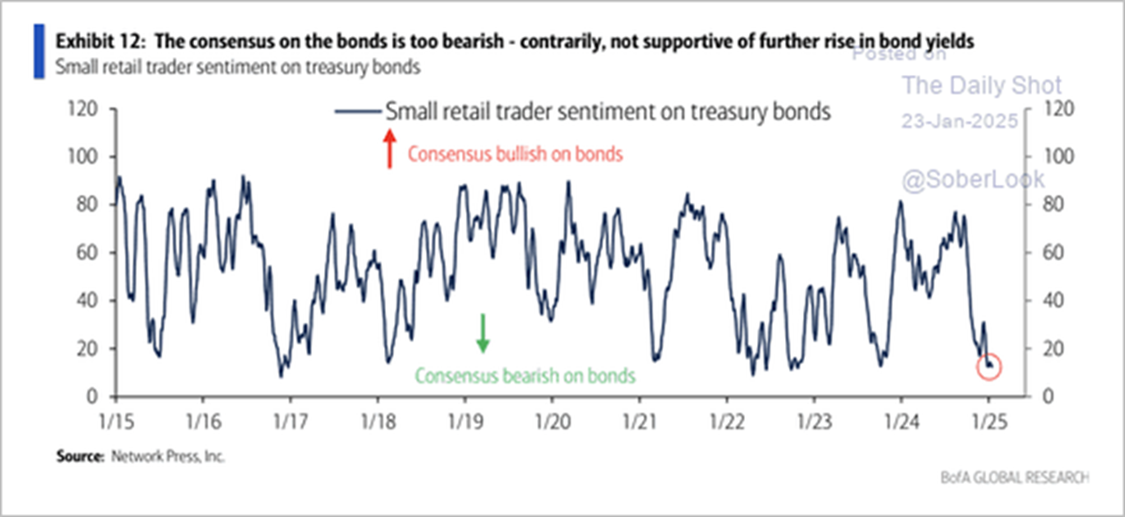

Markets are near all-time highs. And the risk appetite among investors is high but slowing. Fewer and fewer participants push things higher. The bond market is experiencing the opposite. The appetite for traditional bonds is low. As Walter Deemer said, "When the time comes to buy, you won't want to." Sentiment for bonds certainly could fit that statement.

For weeks, I've been waiting for an opportunity to buy more bonds at a historically good value. Why wait? The federal deficit is ballooning, and inflation is sticky. I like where I am and will be patient before making a significant change.

Making sound decisions and sticking with them over the long haul is the cornerstone of investment success. The mission of SFS MarketPoint® is to deliver weekly insights into the economic landscape and spotlight emerging opportunities for investors. Our proprietary system identifies sector and asset class rotations within the markets.