The Only Constant In Life Is Change

When did you last reach down and pick up a penny or even a nickel? It's been a long time for me. The world is digital, and the value of the coins has never been lower. Now, President Trump wants the Treasury to stop minting the penny. We should all get behind this, regardless of our political beliefs.

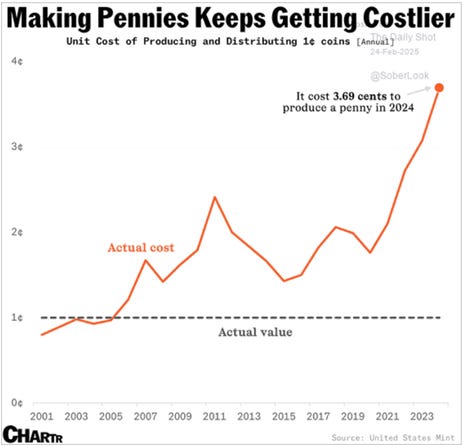

Chart of the Week

Fun facts: The smallest denomination coin ever minted by the U.S. government was a half cent (1793 to 1857). There were also three-cent coins (1851 to 1889) and $3 coins (1854 to 1889).

It costs 3.7 cents to make a penny and 13.8 cents to make a nickel. That’s right. We are losing money, minting every penny and every nickel. The U.S. Treasury minted 4.5 billion pennies in 2023. That is a loss of 121 million dollars. We lost another 85 million dollars on the nickel. These are dollars that get borrowed, and we pay around 4% interest. As a coin collector, I appreciate the sentimental value of these coins, but enough is enough. The value of these coins will continue to decrease, thanks to inflation.

It is a wonder these coins have endured over the last 20 years. The half cent (known as the hay-penny) was decommissioned in 1857. According to Wikipedia, it would be equal to 16 cents today. By that logic, we don’t even need the dime in 2025.

Market Update

Stocks are declining, and bond prices are on the rise. This looks like the beginning of a classic slowdown. It is different than 2022, when both stocks and bonds were falling. The economic narrative says that consumers are cutting back, and so is the U.S. government. There is still little data to show the reality of a significant downturn though. This is why I prefer having signals to rely on. More signals rang last week.

I often refer to signals like I am driving on the freeway. I entered the year traveling at the speed limit in the middle lane. I received the signal in February to slow down, but not to change lanes. Two weeks later, I am increasing my speed (buying more stocks). I am especially interested as the S&P 500 index went below 5,800. With all the changes to increase risk in the last week, I am approximately equal to my benchmarks. There is still room to buy more if even better opportunities emerge.

The adjacent chart shows the S&P 500 index (blue line) over the last 12 months. Green arrows mean speed up. Red arrows signal to slow down. I consider them suggestions for tactical portfolios, and I typically make some modifications when I see a change. The signal is not perfect. No indicator is. This one has been extremely helpful, though.

Regarding positioning, I still have room to shift into the fast lane if we get even better values in the stock market. In addition, my sector rotation continues to have a slight overweight to some defensive sectors. (We sold consumer products and a real estate overweight last week and healthcare earlier today.) Finally, we are riding the momentum in bonds. They have been a helpful diversification in 2025.