The Tale of Two Economies

Two major companies just gave us two very different views of America. Who is right?

“We don’t see any signs of stress in U.S. consumers.”

—Barclays Bank, September 8, 2025

“Middle- and lower-income consumers, they're under a lot of pressure.”

—McDonald’s, September 2, 2025

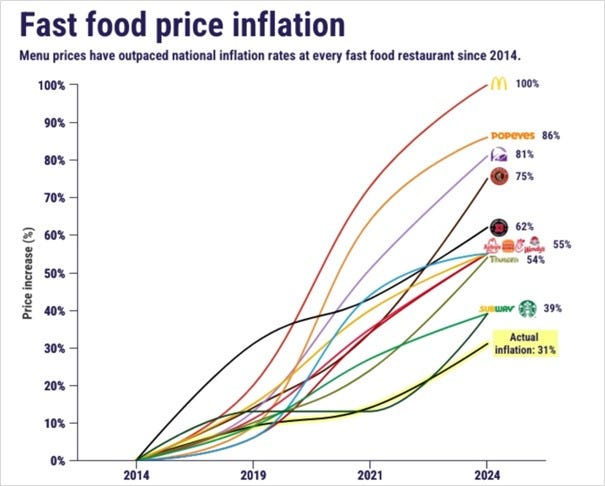

Chart of the Week

Barclays is looking at the economy from 30,000 feet. They see strong spending, stable credit, and a stock market near all-time highs. From that vantage point, things look fine. But McDonald’s is on the ground, and what they see is troubling: a sharp drop in traffic for middle- and lower-income customers.

Since 2014, the Consumer Price Index (CPI) has risen by 31%. But McDonald’s prices have surged far beyond that, up 100%. That’s not just inflation. That’s a shift in affordability hitting some of the most popular American restaurants.

McDonald’s CEO didn’t sugarcoat it. He said plainly: upper-income Americans—those earning over $100,000—are doing well. They’re traveling, investing, and spending. But middle- and lower-income families are under pressure. Some are skipping breakfast. Others are eating at home, not by choice, but by necessity.

This is a tale of two consumers.

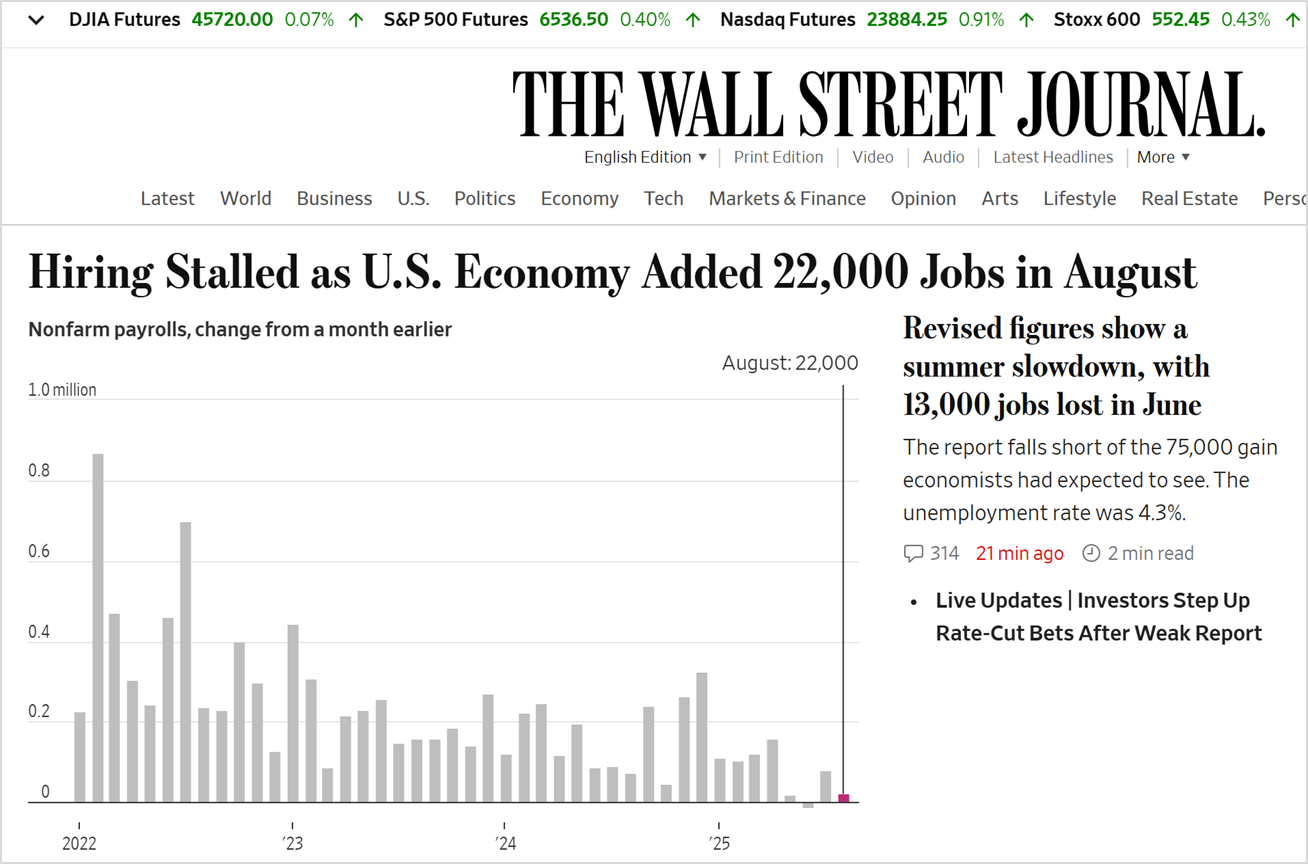

Economic Update

The stock market exploded higher on Friday, September 5th, when the U.S. Bureau of Labor announced the country added just 22,000 jobs—far below the expected 75,000. Investors found hope in the weak report that the Federal Reserve would cut interest rates.