This Time is Different

Few phrases are more dangerous to investors than: “This time is different.” It’s a seductive phrase, fueled by optimism and sometimes fear. You may get lucky, but extreme emotion often leads to poor investment decisions. While every market event, every government shutdown, every trade war, and every housing bubble is unique, history always offers valuable lessons.

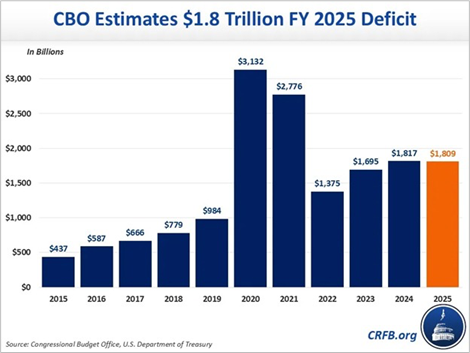

Chart of the Week

The most significant difference in the 2020s has been the U.S. government’s willingness to print money. The government began pumping liquidity (dollars) into the financial system in 2008 to stem the crisis. There was a public outcry at the time from the Occupy Wall Street and Tea Party movements. The government just kept going. It bumped up deficit spending in 2018. Pumped record liquidity again in 2020. And while the Federal Reserve has slowly tapped its brakes since 2022, the Federal Government has been driving with its foot on the accelerator.

Each bar in the adjacent chart represents the government deficit for a specific fiscal year. For example, in 2023, the U.S. government spent $1,695,000,000 more than it brought in through taxes and other revenue. That amount represented a 23% increase in the deficit compared to 2022. Each year, the amount of these deficits is added to the national debt, which is approaching $40 trillion.

One result of the extensive money printing (both digital and paper) has been the decline of the U.S. dollar. In contrast, a positive aspect for investors is that most other major assets have appreciated in the last year. The stock market has been rising. The bond market has gone up. Even gold, which generates no cash flow and pays no dividends, is at a record high. These could be getting tired by now, so caution is always warranted, but when the government prints money, that money circulates until it finds a home. So, keeping an eye on deficit spending is a good idea for investors. Speaking of homes, this is one place showing some cracks in 2025.

Housing Update