Tides of the Ocean

Ocean tides rise and fall in a predictable manner based on the gravitational pull of the Moon, the Earth’s rotation, and the inertia of the tide itself. There are some similarities for investors. The stock market has been surging higher since it bottomed early on Monday, April 7th. It has been a historic recovery, driven by the perception that the tariff trade war is over, and that every actual war will not have long-term consequences. Or was the driving factor just investor flows?

Chart of the Week

This is the CNN Fear & Greed index in early April on the left and early July on the right. Investor sentiment and positioning were defensive at the bottom. And then it all flowed back the other way like the tides of the oceans. I do not trade based on this measurement. I have not found it to be a robust signal. I do find it helpful to understand what is happening.

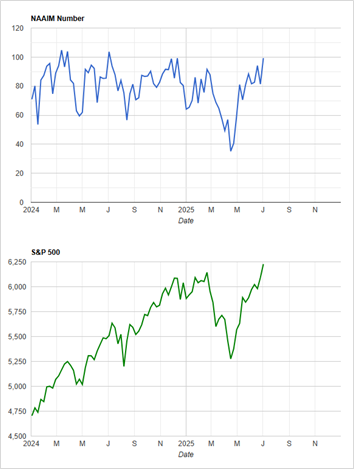

Over the weekend, we learned that positioning by the National Association of Active Investment Managers was at its highest level in 15 months. What does this mean for investors? The tide is high.

The stock market is not a magical money-making machine. It is an opportunity to invest in companies and participate in their potential. We have chosen to manage risks for our clients by holding dividend-paying stocks again. We bought relatively low in the energy sector this year, and we diversified into some precious metal companies. I would love to buy more stocks if my signals give us the green light. We are far from that now. We positioned our ProActive Portfolios for summer volatility, should it occur, and we feel comfortable with the allocation if the markets continue to climb.

Market Update

The drop in the stock market on Monday was no surprise. Few things go straight in any direction. Stocks are no exception. What was the reason for the initial drop? The tariff war is not over. In fact, all these trade deals that we have been promised over the last few months have not yet materialized.

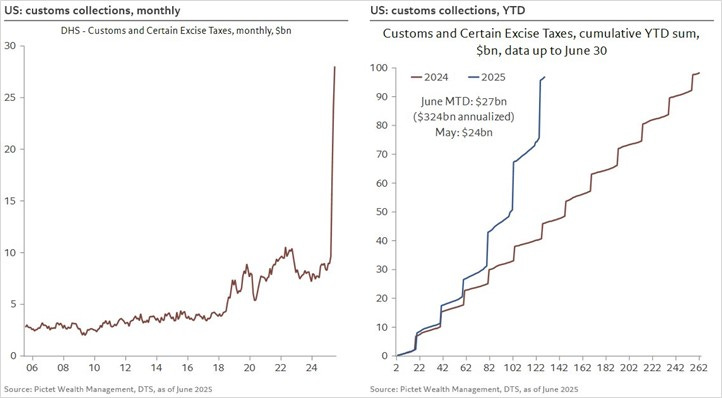

Many goods seem to be skirting the rules by visiting other nations along their journey from China to the United States. According to the Financial Times, trade from China to Vietnam, Indonesia, Taiwan, and a handful of other nations is up significantly. It is no coincidence that trade from those countries to the United States also rose. Some U.S. semiconductors, banned from being sold to China, are circumventing sanctions using similar logistical tactics.

President Trump seems bothered. He has raised tariffs again in recent days on Canada, Vietnam, South Korea, Japan, and several other Asian countries.

This is forcing investors to acknowledge the obvious fact that there is uncertainty. We do not know how high the effective tariff rates will be. They are tax hikes. We still do not know who is paying them. Corporations or consumers. Probably both. We have also not seen an increase in the rate of inflation due to tariffs.

Economic Conditions

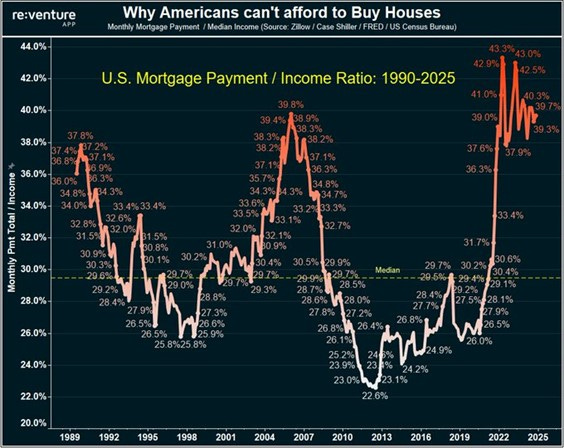

I spoke with a first-time homebuyer last week who lamented the high mortgage rates and is anxiously hoping for interest rates to come down. Rates have not come down. The long-term rates that mortgages tend to follow have been bouncing around similar levels for almost two years. When the Federal Reserve lowered its ultra-short-term rate last year, long-term rates rose significantly. The Fed seemed to ignore it but has now placed itself on pause.

The Fed expects inflation to increase in July due to tariffs. Its members have refused to lower interest rates, taking a wait-and-see approach. The White House is furious about this approach, threatening to stop issuing any new debt that is longer in duration than 9 months (the remaining time for Fed Chair Jerome Powell's appointment). This is coming at a time when the United States has $37 trillion in debt and is growing—growing at the fastest rate since 2008, despite not being in a recession. This is probably how we have avoided recession in recent years.

Market Momentum

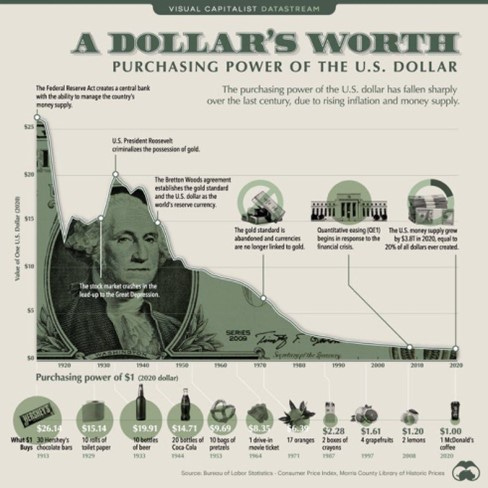

Inflation appears calm on the surface. We have all witnessed the compounding pain it can cause. Over the long term, the impact is shocking. The increase in the supply of money by the U.S. government is one of the biggest causes. As we approach $40 trillion in government debt, the dollar is getting even less attractive to foreign investors. It is down 10% in value so far this year. Just like stocks and bonds, this can fluctuate based on extreme positioning. I do not recommend trading based on the currency. However, it is worth watching.

Making sound decisions and sticking with them over the long haul is the cornerstone of investment success. The mission of SFS MarketPoint® is to deliver weekly insights into the economic landscape and spotlight emerging opportunities for investors. Our proprietary system identifies sector and asset class rotations within the markets.