Uncle Sam is Driving Pedal to the Metal While Much of the Economy is Slowing.

An era of fiscal dominance began in 2009 and intensified in 2020. Once a country leans heavily on stimulus, pulling back becomes politically and economically painful. Austerity sounds responsible—but often backfires. The better path is growth. Data in the last week has called our current growth rate into question.

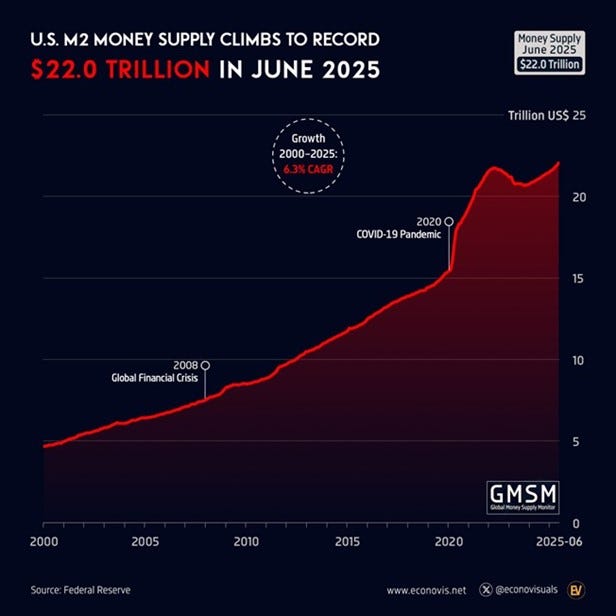

Chart of the Week

One of the most telling indicators is M2—the broad measure of U.S. money supply. In June, it rose 4.5% year-over-year, hitting a record $22.02 trillion. That’s 20 straight months of increases, and the most significant jump since mid-2022.

This growth reflects how the game is played now: fiscal policy and financial markets are deeply intertwined. The government is still printing and spending, and that liquidity is flowing somewhere.