What Could Happen to Investors During the U.S. Government Shutdown?

Government shutdowns are not good for the economy, no question. They are an emotional rollercoaster with fast dips and sudden turns. While some will exit with just whiplash, others will be hurt. It is my job to consider the impact on investors. Here is my advice: “Keep your arms and hands inside the ride at all times.” The shutdown has begun.

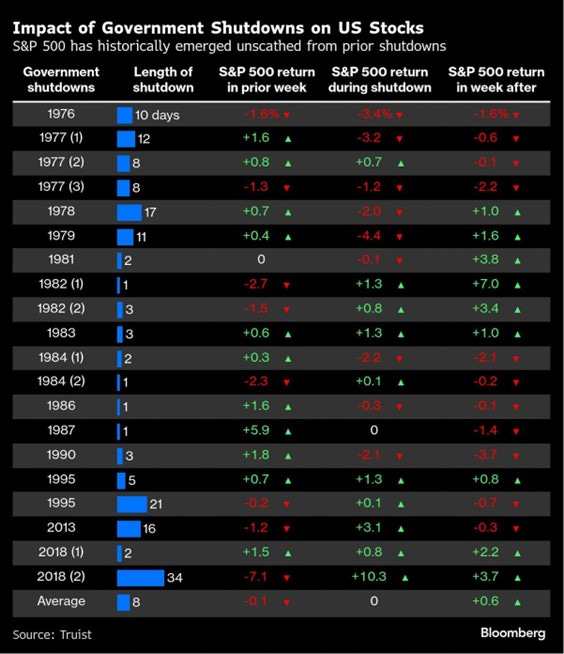

Chart of the Week

According to Bloomberg, shutdowns and partial shutdowns have occurred in 2018, 2013, 1995, 1990, and 1987 (See graphic). President Trump was part of one that began on December 22, 2018. Like those before him, he attempted to shift public blame to the other party. The other party tried to do the same to him. Typical. The same is being done in 2025. It is only relevant to the article as it could impact how willing each side is to negotiate. Political parties are likely to lower their demands if they feel they are losing the political battle.

Only federal employees who are essential, such as prison guards and TSA workers, will continue to perform their jobs. When the shutdown ends, everyone receives back pay, even those who did not have to work. Social Security, Medicare, and Medicaid continue, as does the IRS. Consumer spending shifts, especially around federal buildings, but it continues, as does the entire economy.

When the government shutdown occurred in 2013, I wrote about it. Then, the S&P 500 moved up over 4% in the 2.5 months prior, then gave back most of those gains in the two weeks centered around the start of the shutdown. Then it bounced. The total S&P 500 return during the shutdown was approximately 3%. Bonds were steady, and gold was down some. I consider that a muted response, considering that the government sent 850,000 federal workers home for 16 days.

What about the shutdown that began on December 21, 2018, that lasted twice as long (35 days)? The S&P 500 lost 17% in the months leading up to the shutdown and reached its bottom on the first business day after the shutdown. Over the 35 days, the index gained 10% and returned to new highs by the end of April.

Our current situation looks different than either of these. We are in the middle of a 1999-like explosion in data-center spending. The market has not had a meaningful drop since March. And the government has the money printers figuratively running at maximum speed. Those who make the “rational decision” to stop investing may not do as well as they expect. Shutdowns happen, and history suggests it is usually better to stick with your long-term plan.

Making sound decisions and sticking with them over the long haul is the cornerstone of investment success. The mission of SFS MarketPoint® is to deliver weekly insights into the economic landscape and spotlight emerging opportunities for investors. Our proprietary system identifies sector and asset class rotations within the markets.