What Will Housing Prices Do Next?

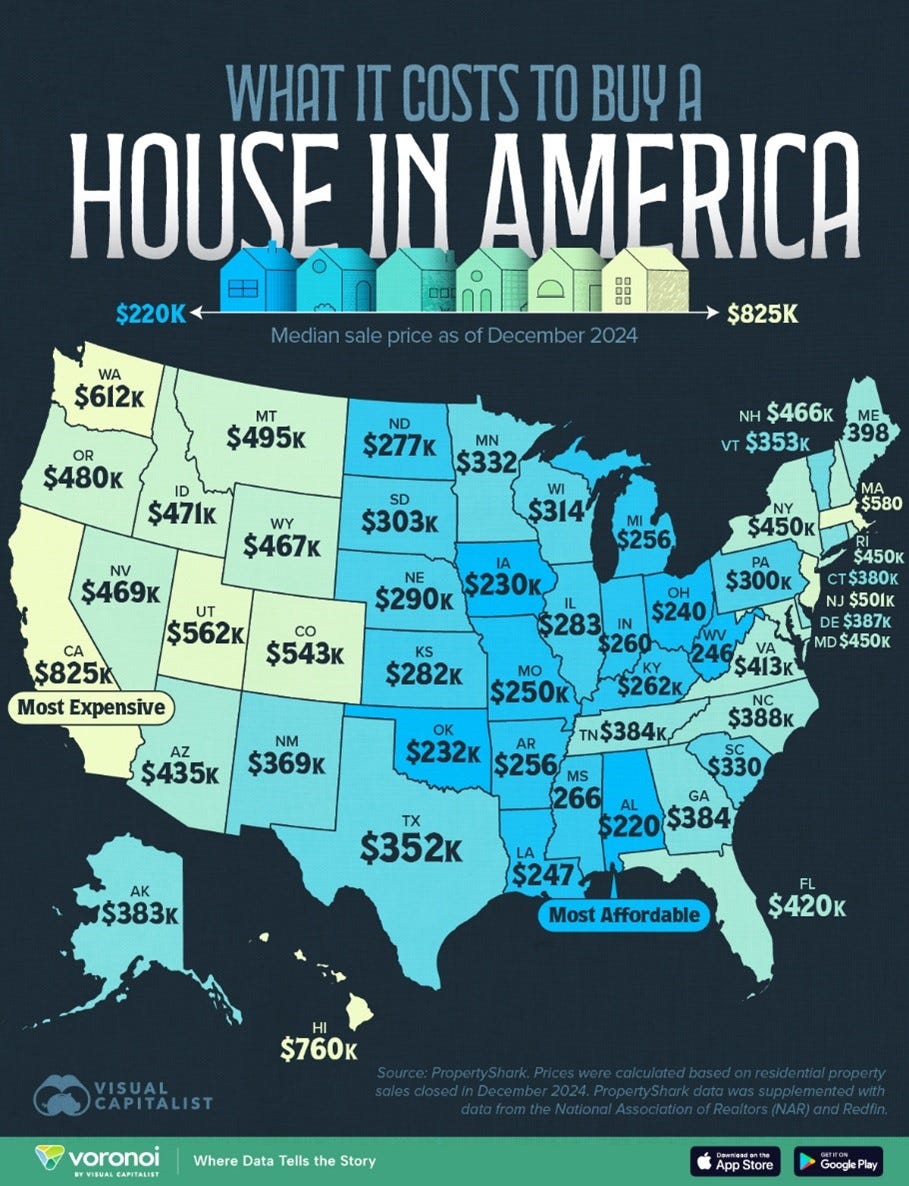

Homes have always felt expensive. They have never cost more than they do today. Comparing historical prices with average incomes offers further evidence. They are nearly unaffordable for the average American. And while falling interest rates have been helpful, they may not be enough. Change is coming.

Chart of the Week

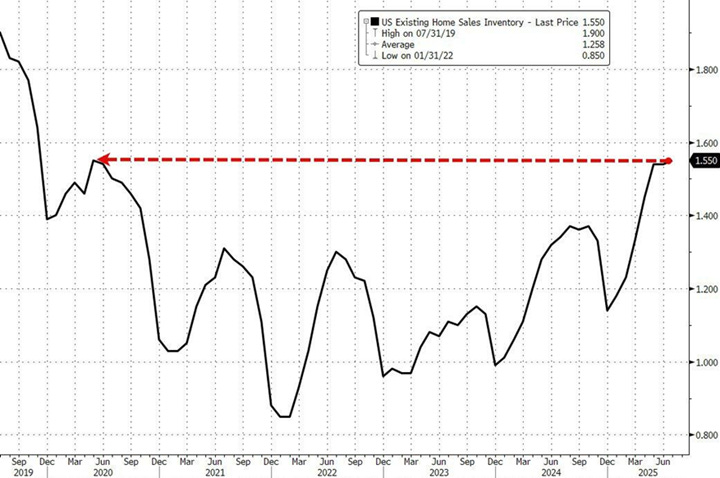

Like everything in economics, the price of homes is determined by supply and demand. Currently, supply is up, and demand is down. This may not be a disaster for everyone. It will help resolve a situation we have been locked in for several years.

How will it happen? It already began in the cities most inflated with high prices and massive new supply.

Supply is up. Demand has not risen with it. Economics teaches us that prices should change. That may take time, and it will likely spread from overpriced epicenters. How concerned should we be? Are we in a housing bubble like in 2007? I don’t believe so.

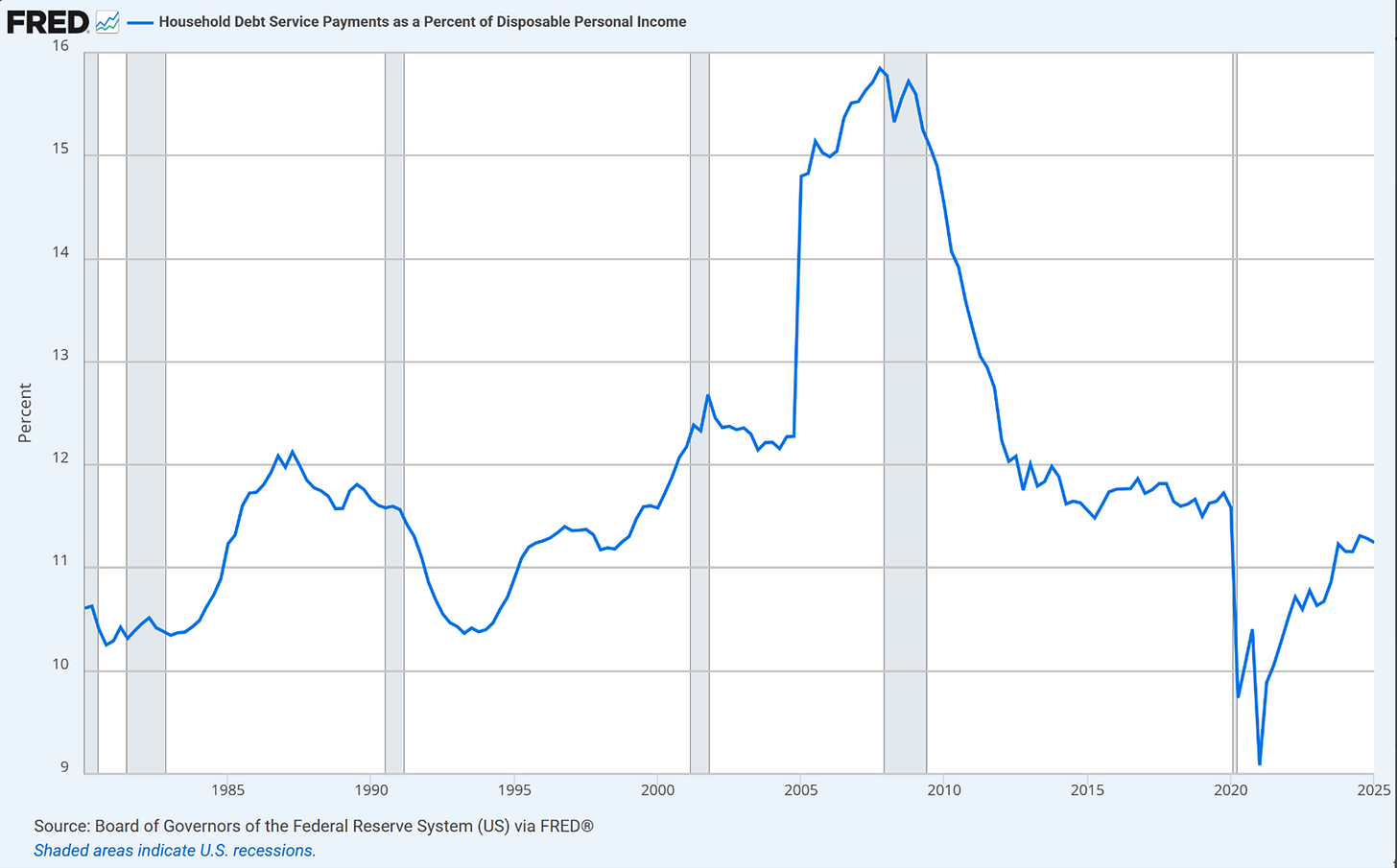

There is a saying about bubbles. It is not the price level that matters. It is the financing. The leverage in real estate is not nearly as problematic as in the past, and it is nothing like the years 2006-2008. Total debt payments as a percentage of income appear reasonable. I expect a more reasonable repricing of American homes in the coming years. Even a small reduction in prices could be devastating for some. If you or anyone you know is struggling to make their debt payments now, it's better to get things in order just in case.