Who Cares About Government Debt?

Little good news was not a problem. Major stock indices continued to grind higher last week. I interpret it as evidence of how offsides many investors have been over the last two months. Many missed out on the bounce and have been feeling anxious. Fortunately, that has not been us. No FOMO driving our decisions to buy and no FOMO in managing our risk today. Just discipline in our system.

Positioning is more neutral now. Data will matter more in June than it did in May. That data will be driven by federal spending. This is what has upset Elon Musk, America’s richest resident. He began a public feud with the President last week over what Musk views as excessive spending. The media chose to focus on the drama. I am more interested in the substance of the debate.

Chart of the Week

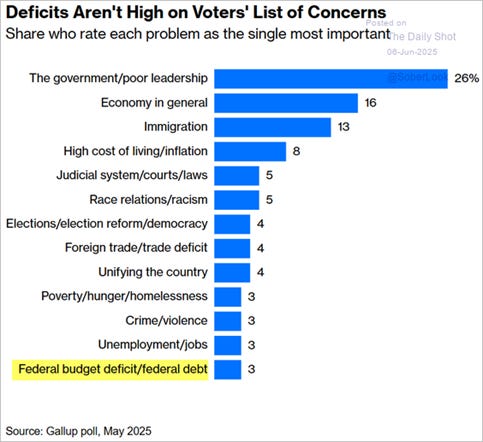

Elon Musk appears to be concerned about government debt. Does anyone want to join him? Anyone? Anyone? It’s not just the politicians. As this Gallup poll indicates, Americans do not seem to care much about the deficit. It has not always been this way.

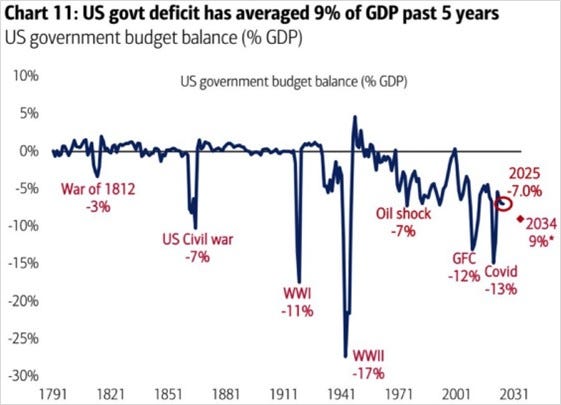

After almost 200 years of worrying about the federal debt, the living generations have become numb to the issue. Deficit spending has historically increased in times of emergencies, such as war and recession. That debt diminished in good times. Things changed in the 1970s as deficit spending (the falling blue line) became more regular. After the year 2000, no serious attempt has been made to get the blue line up near zero.

The Trump administration claimed it would deliver -3% deficits. Negative is negative, but that number is roughly equal to economic growth, and for that reason, many thought it would be reasonable. Then came the “Big Beautiful Bill.” The administration has chosen to shift spending around without significant reductions to this deficit. They believe that economic growth will compensate for the difference. My thoughts? Throughout my career, every politician has hoped that growth would make up for the difference. The problem, in part, is the multiplier effect, which I wrote about in a recent SFS Money Moxie article. I do not expect politicians to present a real solution until Americans want a real solution. Until then, what should investors do?

More government debt for spending should be positive for stocks. Every deficit dollar spent is a corporate profit, and more interest is paid to savers in the coming years. There is no guarantee. This is one reason why I developed a rotational strategy for tactical portfolios. It does not rely on predicting good news, which sends stocks up, or bad news, which sends stocks down. My rotational strategy enables me to stay invested in the areas I believe should be overweighted in the coming months. As discussed last week, energy stocks looked more attractive than the broad market in my system. I waited long enough. I added more energy last Thursday.