Who Celebrated Liberation Day?

Congratulations! You survived 7 of the craziest days in market history. President Trump lit the markets on fire with his Liberation Day tariffs and partially extinguished the flames precisely one week later. He is celebrating his impact. Should investors join the celebration or just be grateful that Liberation Week is over?

Chart of the Week

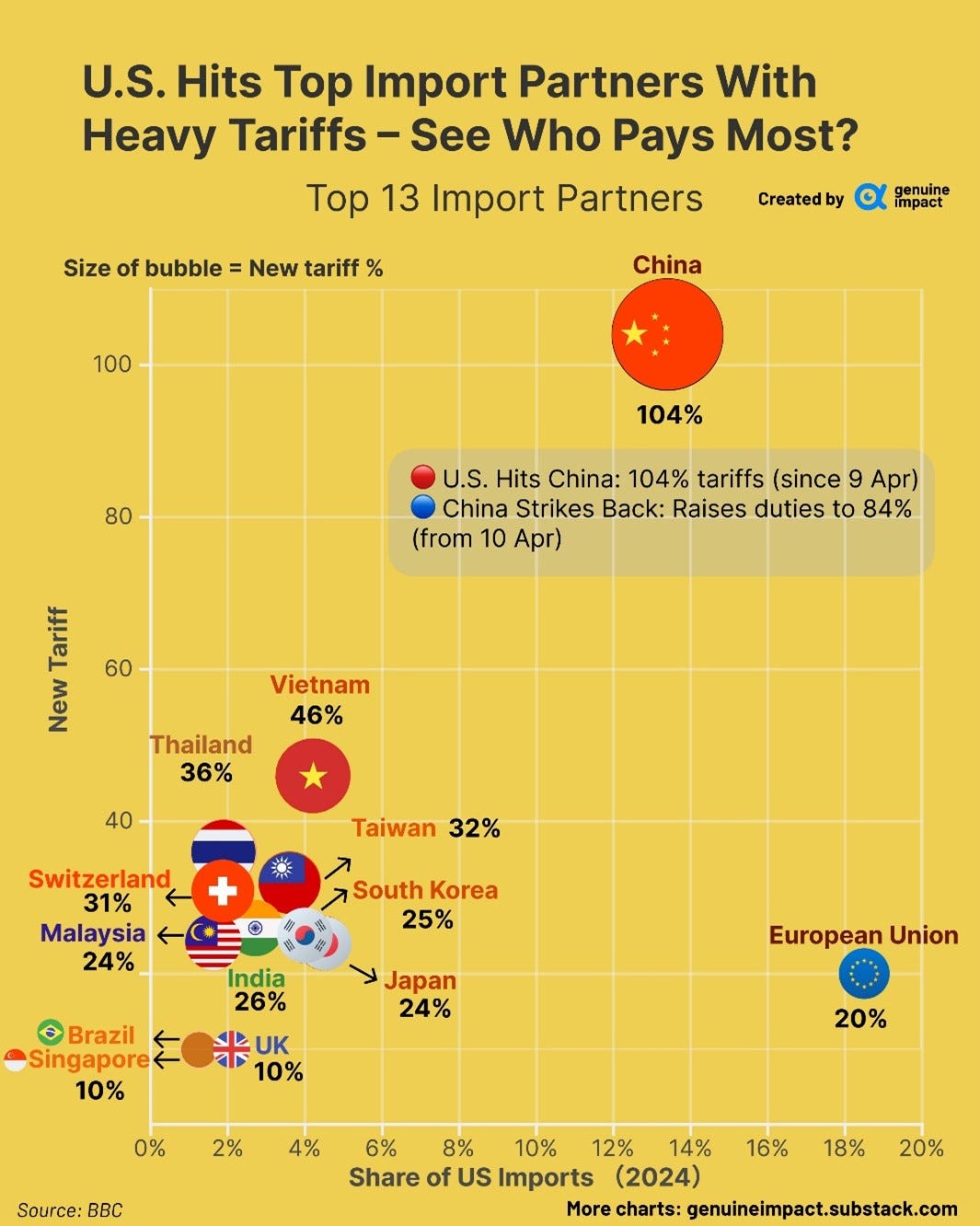

The White House sees tariffs as part of a plan to get Americans less reliant and less involved in foreign affairs. The tariff part of the plan appears to be backfiring. Rising interest rates and deteriorating public opinion led the President to declare a 90-day delay on new tariffs, except for China.

President Xi increased tariffs and restricted the export of rare earth metals. Xi declared that further tariff escalation is pointless, stating profitable trade between the two countries is over. China will not back down.

On Saturday, President Trump backed down again, this time on consumer electronics. Markets cheered on Monday. Then news came out that there was no exception, and the President would clarify at the end of the week. Stocks dropped a little. Do you see the pattern?

Investors do not like tariffs because they are a form of tax. In this way, 2025 may be the year of the largest tax increase in U.S. history. The question is still, “Who will pay the tariffs?” We are all waiting to find out if prices go up. Consumers are likely to cut back if they do. If not, then corporations will pay, decreasing profits. Denise Chisholm of Fidelity estimates a 1-2% drag on GDP—not enough for a recession but closer to zero.

The possible gain from the government collecting tariffs comes if it cuts taxes in some other area. We have not seen this yet. Uncertainty has been the result, and it has caused a lot of damage to the stock market already.

The biggest surprise would be an improvement in the tariff situation, which could happen anytime and be good news for investors. I see this as very likely, but I have no way of knowing if or when President Trump will back down against China.

April’s early wild ride confirms timeless truths: stock markets are tough to time. Stick with your long-term plan; you do not have to make big changes. If the market presents a great opportunity, then act. Otherwise, wait. We have already identified several opportunities this year: We entered the year with recommendations to hold bonds, as well as stocks focused on consumer products, utilities, healthcare, energy, and gold. We feel good about how all of these turned out. We are looking forward to more signals coming. After the one-day bounce of 10% in stocks, we sold a little. Now, we are holding for the next signal.

Market Update

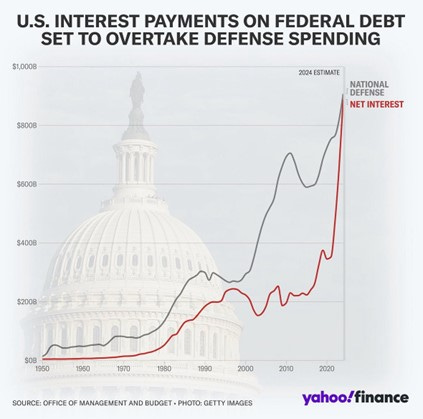

The U.S. Treasury will issue around $9 and $10 trillion in debt this year. Most of this is refinancing existing debt that is maturing. The rate the government agrees to pay is a major concern for the White House. Just look at the red line in the adjacent image. Now, imagine life in America if we do not get this under control. We cannot continue down the path we have been on for the last 15 years.

Some argue federal debt doesn't matter, but interest does! Federal debt has ballooned since 2008. The burden on the American public (red line) became punishing when rates rose. When were the mistakes made? Every year since 2018, but especially beginning in 2020. Whatever we do, lowering rates without triggering inflation or a recession would be most helpful.