Will Investors Approve of the Fed Decision?

“We don’t have to be smarter than the rest. We have to be more disciplined than the rest.”

- Warren Buffett

This is an important week for government policy: the European trade agreement, the U.S. government’s quarterly funding announcement, and the Federal Reserve will make its latest change (or no change) to interest rates. All that by this afternoon! Most investors are hoping these will pour gasoline on the economic fire. We will have to wait to find out.

Chart of the Week

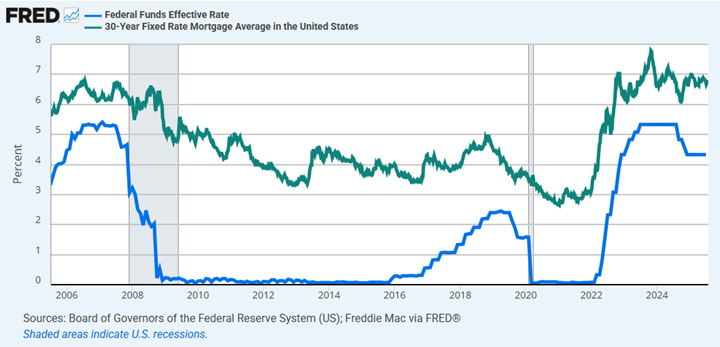

What happens if the Federal Reserve cuts its overnight interest rate this afternoon? Last year, the Fed cut rates by 1%. The ten-year rate went up, not down. Mortgage rates and auto loans mostly increased. When the Fed implements policies that most investors agree with, the bond market tends to move in line with the Fed. If investors dislike the central bank's decisions, rates will likely move in the opposite direction.

Europe has its own central bank, the ECB. It has lowered rates this year. Investor response was similar to that in the United States in 2024. Interest rates moved higher in Europe. What is the impact? The short-term rates have an indirect and gradual impact on us as consumers. The intermediate and long-term rates have a direct and more immediate impact on our finances. They are quickly manifested in the rates available to Americans when we borrow.